To err is human, but to repeat the same mistake over and over again when we already know how disastrous its consequences are? This is the domain of the European Commission.

In the coming months, we will see new fiscal rules for the Eurozone, which will replace the Stability and Growth Pact (SGP) and the Fiscal Compact. The Council of Ministers of Finance and Economy of Member States (ECOFIN) will soon take key decisions – including the possibility of maintaining the old rules. The existing rules are ineffective, too transparent and difficult to enforce General agreement.

First, in November 2022, the European Commission he suggestedthat countries exceeding the deficit (3% of GDP) or debt (60% of GDP) thresholds set by the Stability and Growth Pact. introduced A four-year plan to adapt to the standards, prepared according to the specific conditions of the country.Analysis of debt stability” (taking into account interest payments and the impact of so-called automatic stabilizers). Member states must be monitored to ensure they maintain the agreed “technical trajectory”, but could request a three-year extension of the transition period, provided they demonstrate a strong commitment to structural reforms and growth-enhancing investment.

Varoufakis: Belt-tightening destroyed Europe. And now he's back

Krakow market

In April, the commission changed his sentence. In the new version, medium-term adjustment plans to fiscal conditions were to be more “owned by member states”. They were to present the plans to the commission and then present them to the council for a vote. excited However, the concern of states “economical” – and to appease them, the Commission announced tougher rules for the most indebted countries. It was agreed that the debt-to-GDP ratio at the end of the plan should be lower than at the beginning to avoid last-minute adjustments. In addition, it was decided that countries with deficits exceeding 3 percent of GDP should achieve an additional debt reduction of at least 0.5%. GDP

However, for Germany and other countries such as Austria and the Netherlands, this more restrictive attitude was still there very soft. In their opinion, they criticized too soft restrictions on public spending and too weak incentives for “structural reforms”. Germany They raised the barA proposed new floor for mandatory debt reduction to be introduced after the end of the adjustment period and a “safety margin” for budget deficits. in an amount that has yet to be determined, but 3%. GDP They also demanded that the growth of government spending never exceed the growth of potential GDP, which risks further exacerbating extreme phenomena in the business cycle.

Amid growing conflict between economies led by Germany and other member states (led by France and Italy), Spain – which held the EU presidency – tried to persuade the conflicting parties to meet halfway. He adopted the German idea of reducing average annual debt by 1%. GDP (for four or seven years), and on the other hand, extended the time horizon (up to 14 or 17 years). According to the website politics The Spanish proposal gained more support.

Meanwhile, Italy and France requested to accept the application The golden rule of budgeting, that is, they demanded that certain investments (in the case of Rome – green and digital, in the case of Paris – related to defense) should not be taken into account when calculating the ratio of debt to GDP. At the end of November, the President of the European Commission, Ursula von der Leyen, attended the annual conference of the European Defense Agency. she saidthat there is already broad support among member states for considering defense spending as “an important factor in assessing excessive deficits,” suggesting that there is room “to reduce the fiscal effort required in the short term for those member states at the same time as they increase defense spending.”

victims of their own contradictions

But let's leave the intergovernmental dispute. At a deeper level, Europe is still a victim own contradictions: Adherence to pro-cyclical fiscal policy (that is, one that favors extreme phenomena in the business cycle), a deflationary model of economic growth, and the chaos of institutions in constant conflict with each other. These contradictions contain the seeds of another systemic crisis that could threaten the future of the Union. One may get the impression that the crises of the last decade did not exist at all or that no one learned from them. No conclusions – contrary to the Latin proverb Errare humanum est, sed in errare perseverare diabolicumThat is, to err is human, but to continue to err is diabolical.

First, the ideological basis of all the proposals that entered the negotiation game remains the same Belt tensioning rules. Public spending is still seen as an expense to be minimized rather than an investment that leads to economic growth – nobody in Europe seems to have read any of Keynes' work.

It is time to reveal the logic of “public debt market discipline”.

Read also

Public debt is perceived almost as much as private debt, that is, as a liability that must be reduced – and no one considers the negative consequences of spending cuts or privatization (which has an even stronger effect). And yet the International Monetary Fund He sees it todaythat, depending on the size of the multipliers, fiscal consolidation (ie, policies aimed at reducing budget deficits and debt accumulation) in developed economies usually leads to an increase in the debt-to-GDP ratio. A one-time increase in budget revenues may also occur as a result of privatization adjournment to the permanent and painful destruction of production and/or technological capabilities.

They can be a warning ItalyOnce a flagship example of austerity policies. They once boasted record budget surpluses for the first time, and after adopting the euro they became leaders in terms of economic liberalization and labor market “flexibility” that other countries in the zone could not match. However, it is well knownWhat did this entail?

Italy has a long-term stagnation of labor productivity, a high public debt burden, an economy highly sensitive to periodic increases in interest rates, and unemployment consistently above the EU average. This country shows how misguided economic policies are based on productivity and growth through economic restrictions, various forms of liberalization and demand suppression (especially in the public sector). This leads to a deepening of weaknesses and an increase in risk factors, and as a whole threatens the survival of the entire union.

Read also

Second, the “debt sustainability analysis” methodology is based on the same “voodoo economics” principles as George W. Bush. he called mockingly Ronald Reagan's tax cut program when he contested it in the Republican primary in the 1980s – which until recently was still popular with European decision makers. They are still in this macroeconomic model Crossed by theory and Fundamentally procyclical Concepts such as “potential GDP growth”, “GDP gap” and “structural budget balance”. On the other hand, forecasts, which are based on the projection of the current situation into the future, introduce dependence on the chosen path and the so-called “Technological trajectories” in the model. For example, according to the latest debt sustainability report forecast (Debt Sustainability Monitor) the primary balances of Italy and Germany will remain negative until 2033 (and amount to -2.2 and -2.6% respectively).

No one even considers the economic interdependence between different countries. The potential negative macroeconomic effects of a reduction in demand in highly indebted member states on other EU countries were completely ignored. Similarly, the question of reducing demand in countries with low debt was discussed.

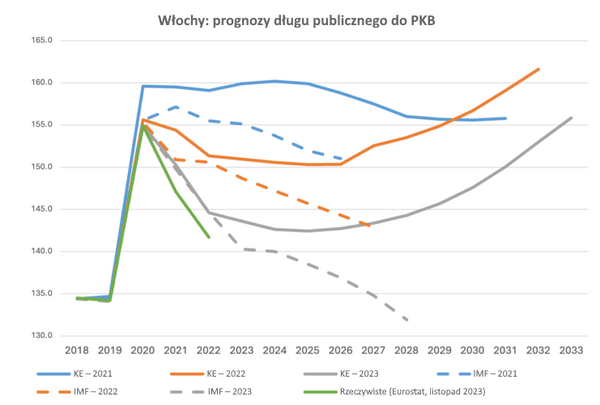

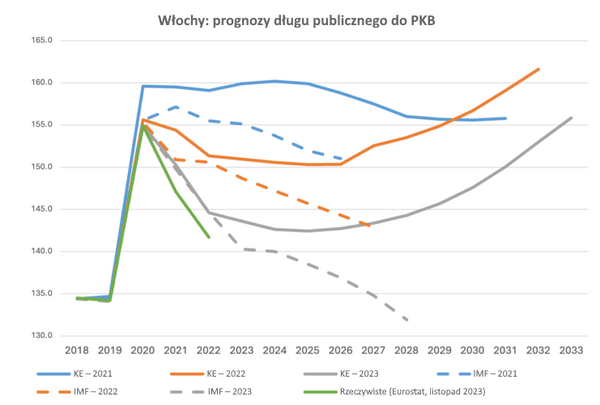

Hawk on the attack

However, the Commission appears to have taken a remarkably blunt approach. Despite using the IMF's methodology, its forecasts are always more pessimistic, as shown in the graph below of Italy's debt-to-GDP ratio. In 2021, 2022 and 2023, the level of the indicator predicted by the Commission was worse and actually achieved than the forecast of the International Monetary Fund (green line). Today, the IMF predicts a stable debt trajectory, while the Commission expects an upward trend. This difference is due to different assumptions made for the “structural” deviation of the primary balance: the IMF assumes a return to the average value of the past 15 years and the Commission expects it to remain at current levels.

What will be the impact on public policy? The director of the Bruegel Research Institute lifted the veil of secrecy… workshops Organized by the think tank Dezernat Zukunft and the Vienna Institute for International Economic Research WIIW. According to the new debt sustainability analysis framework, Italy is expected to reach a primary balance of +3.2%. At the end of the four-year adjustment period. It would be an unprecedented turn to austerity – worse than during the worst moments of the eurozone crisis. Although the height of the indicator is only a rough estimate, it shows how powerful it is Slope on the belt tightening side The commission still has.

The review of fiscal rules is now entering a crucial phase; The most important decisions are made. Their potential implications go beyond technical issues. A dangerous debt-reduction-at-any-cost mentality is dangerous, as history has shown time and time again.

Poverty is a political decision. How austerity policies work

Read also

Instead of going down this path, the EU should learn from its mistakes and recognize the importance of public investment, structural interdependencies and the unique circumstances of each member state. It should also be remembered that rules (including fiscal rules) are a means to an end, not an end in themselves.

The EU must chart a new course and find the courage to finally face the fundamental contradictions it has so far avoided – to stimulate economic growth, support the green and digital transformation and maintain debt stability.

**

Dario Guarasio He is a professor of economic policy at La Sapienza University of Rome. It is also affiliated with the Scuola Superiore Sant'Anna University in Pisa. He researches the economics of innovation, digitization and labor markets, as well as European economics and industrial policy.

Francesco Zeza He is a researcher at the Faculty of Economics and Law of La Sapienza University of Rome and the Levy Institute of Economics at American Bard College. Her research interests include modeling, economic policy, regional development and gender in the economy.

Article published in the magazine Social Europe. Translated from English by Maciej Domagała.

(translate tags) economy