Increasing the tax-free amount is one of them “PO Specifications”, which should be implemented during the first 100 days of the government. “We will reduce taxes. People who earn up to PLN 6,000 in total (also from business activities) and receive pensions up to PLN 5,000 in total will not pay income tax. We will increase the tax-free amount – from PLN 30,000 to PLN 60,000. , of the tax scale In case of settlement of payers, including entrepreneurs and pensioners” – this is the fourth “specific” of the platform.

Neneman: reduction of cargo by about PLN 48 billion

“It is estimated that the increase of the tax-free amount from PLN 30,000 to PLN 60,000 could result in a reduction of the personal income tax burden by approximately PLN 48 billion,” Neneman wrote in response to a December 27 parliamentary interpellation. 2023 (reference number DD1.054.19.2023), cited by Business Insider Polska.

Experts estimated how much such an increase would cost the state budget. The portal emphasized that the budget value will be PLN 38.5 billion per year.

“According to the draft state budget for 2024, PIT revenue this year is expected to be PLN 109.2 billion. If the PO fulfills its pre-election promise, that is, to increase the tax-free amount from January 1, 2024, the state budget revenues will decrease to PLN. 61.2 billion. According to Minister Yaroslav Neneman's answer to a parliamentary question, this level of PIT income was… in 2007! At that time, the budget income from PIT amounted to PLN 61 billion,” reads the subsequent article.

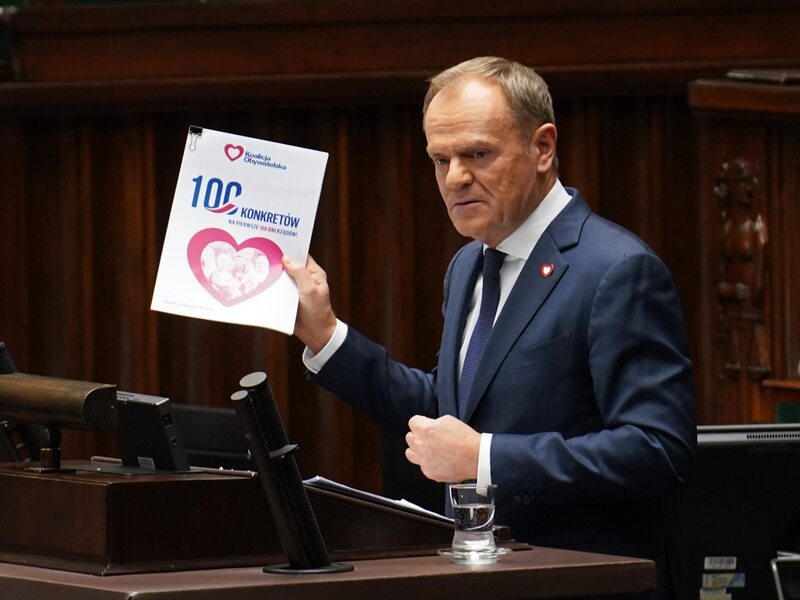

Business Insider reminds you that at the beginning of December, Prime Minister Donald Tusk announced that the tax-free amount has increased from PLN 30,000. PLN up to PLN 60 thousand PLN is still possible, but such a proposal will not be made within 100 days of the government.

Also read:

Let's beware of “good-hearted” politicians!Also read:

What about inflation? Recent forecasts are optimistic

(translate tags)tax free money